Paul B Insurance Fundamentals Explained

4 Easy Facts About Paul B Insurance Shown

Table of ContentsNot known Incorrect Statements About Paul B Insurance The Paul B Insurance IdeasMore About Paul B InsuranceThe Facts About Paul B Insurance UncoveredThe Definitive Guide to Paul B InsuranceSome Known Factual Statements About Paul B Insurance

Coinsurance: This is the portion (such as 20%) of a clinical fee that you pay; the rest is covered by your health and wellness insurance policy plan. Insurance deductible: This is the quantity you spend for covered medical treatment prior to your insurance begins paying. Out-of-pocket optimum: This is the most you'll pay in one year, out of your very own pocket, for protected health and wellness care.

Out-of-pocket prices: These are all expenses above a strategy's costs that you should pay, including copays, coinsurance and also deductibles. Premium: This is the monthly quantity you pay for your medical insurance plan. As a whole, the higher your costs, the lower your out-of-pocket prices such as copays as well as coinsurance (and the other way around).

By this step, you'll likely have your alternatives limited to simply a couple of plans. Right here are some things to take into consideration next: Examine the range of solutions, Go back to that recap of benefits to see if any one of the plans cover a wider range of solutions. Some may have far better protection for points like physical therapy, fertility therapies or mental healthcare, while others might have far better emergency insurance coverage.

Some Of Paul B Insurance

Sometimes, calling the plans' client solution line may be the most effective means to get your concerns addressed. Write your concerns down in advance of time, as well as have a pen or electronic device convenient to videotape the solutions. Here are some examples of what you might ask: I take a certain medicine.

See to it any type of plan you choose will certainly spend for your routine and needed treatment, like prescriptions as well as specialists.

As you're searching for the ideal medical insurance, an excellent step is to determine which plan type you require. Each strategy type equilibriums your prices as well as risks differently. Consider your healthcare usage and budget to find the one that fits.

Wellness insurance policy (likewise called health and wellness coverage or a wellness strategy) assists you pay for medical treatment. All wellness insurance plans are different.

All About Paul B Insurance

You can discover plan recaps as well as get info about wellness strategies for you and your youngsters in your state's Health and wellness Insurance policy Industry. Each strategy in the Industry has a recap that includes what's covered for you as well as your household.

When contrasting medical insurance strategies, check out these prices to assist you choose if the strategy is right for you: This is the quantity of money you pay every month for insurance coverage. This is the quantity of money you have to spend prior to the strategy starts spending for your healthcare.

Your insurance deductible does not include your costs. (likewise called co-pay). This is the quantity of cash you pay for each health and wellness treatment solution, like a check out to a health treatment carrier. This is the greatest amount of cash you would certainly have to pay each year for health care solutions. You don't i was reading this have to pay greater than this amount, even if the solutions you need cost much more.

Right here's what to search for in a health and wellness plan when you're thinking concerning providers: These service providers have a contract (agreement) with a health insurance plan to offer medical services to you at a discount. In a lot of cases, going to a favored carrier is the least costly way to get healthcare.

Some Ideas on Paul B Insurance You Need To Know

This means a health insurance has different costs for different see here now companies. You might need to pay even more to see some service providers than others. If you or a family members participant already has a health and wellness care supplier and you intend to keep seeing them, you can discover which prepares include that supplier.

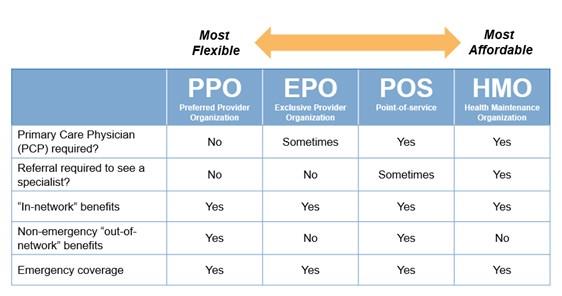

When comparing medical insurance strategies, comprehending the distinctions between health and wellness insurance policy types can assist you pick a plan that's finest for you. Wellness insurance is not one-size-fits-all, as well as the variety of options shows that. There are a number of sorts of health insurance coverage intends to choose from, and each has connected prices and also limitations on carriers and check outs.

To get in advance of the video game, examine your present health care plan to review your coverage and recognize your strategy. As well as, examine out for even more certain health care plan information.

Some Known Factual Statements About Paul B Insurance

If it's an indemnity plan, what kind? With numerous plan names so vague, how can we figure out their type?

A plan that contracts with clinical companies, such as healthcare facilities as well as medical professionals, to produce a network. Clients pay less if they make use of carriers that belong to the network, or they can use providers outside the network for a greater price. A strategy making up groups of medical facilities and doctors that contract to provide comprehensive clinical solutions.

Such plans usually have differing protection levels, based upon where service occurs. The plan pays extra for service executed by a restricted set of suppliers, less for solutions in a broad network of suppliers, and even much less for services outside the network. A plan that supplies pre-paid thorough clinical care.

How Paul B Insurance can Save You Time, Stress, and Money.

In Display 2, side-by-side comparisons of the six kinds of medical care strategies reveal the distinctions determined by responses to the four concerns concerning the strategies' features. As an example, point-of-service is the only plan kind that has greater than 2 levels of benefits, and fee-for-service is the only type that does not utilize a network.

The NCS has not added strategy kinds to make up these but has classified them into existing plan kinds. As before, the strategy name alone could not recognize an unique and regular collection of attributes. NCS does tabulate information on some of these unique strategy features. In 2013, 30 percent of medical strategy individuals in exclusive market were in plans with high deductibles, and of those employees, 42 percent had access to a wellness financial savings account.